Income tax calculator adp

Saving for a large purchase. Tax Tools and Tips.

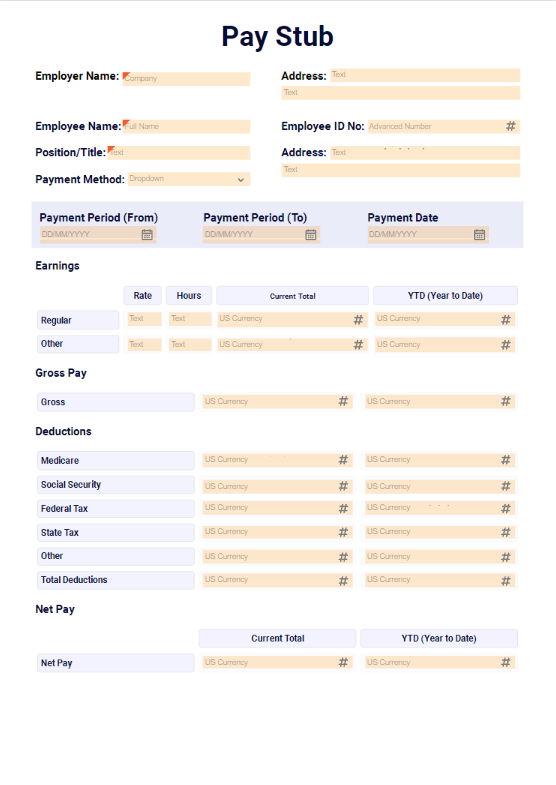

Adp Check Stub Maker Without Coding Airslate

Posted on March 20 2017 0334pm.

. A pay stub often includes. OnPay is a straightforward all-in-one payroll and HR solution for small businesses. Calculating your New York state income tax is similar to the steps we listed on.

The percentage method is the easiest way to calculate bonus taxes. Now for high income earners. Ways to Bank.

Tools to help eliminate redundant data entry and make it easy to generate essential financial reports for audit-proof tax returns. Tax free savings TFSA Retirement savings RRSP. If a parent does not have a source of income the court may calculate income based on prior work history andor the parents potential earning capacity.

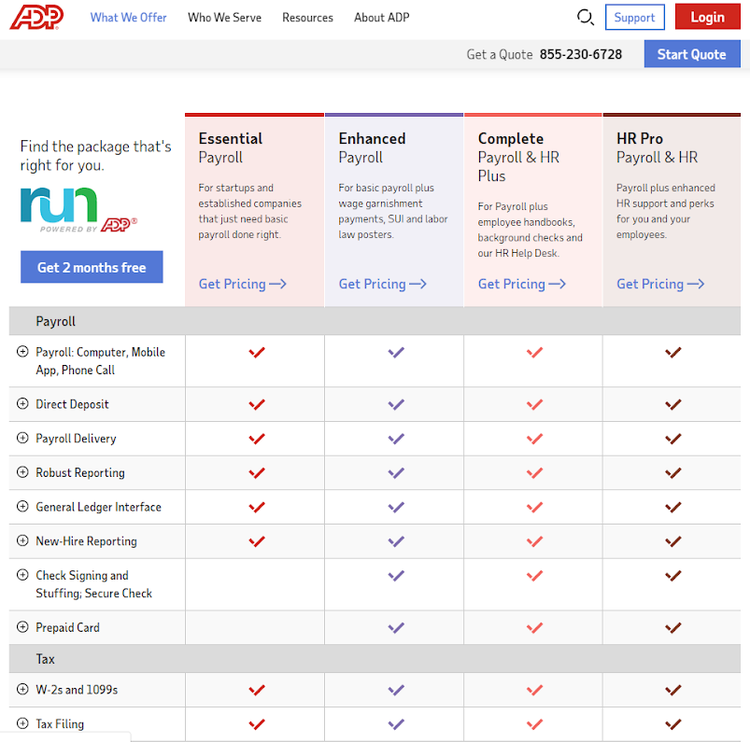

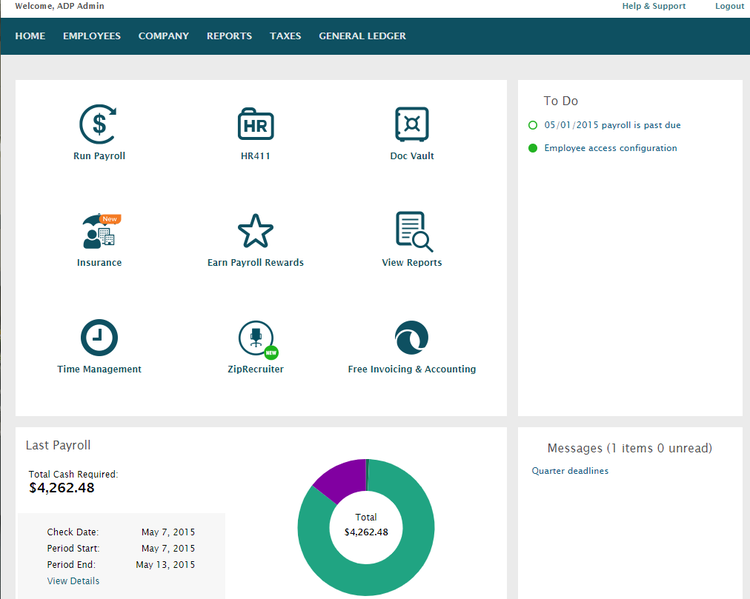

The 29 tax we already discussed and an extra 09 tax on all income above a threshold. ADP offers industry-leading online payroll and HR solutions plus tax compliance. Heres a step-by-step guide to walk you through the tool.

Using this method you withhold a flat income tax rate of 22 from the bonus amount. This calculator is for you. Track income and deductiblereimbursable expenses as well as review and approve expense reports.

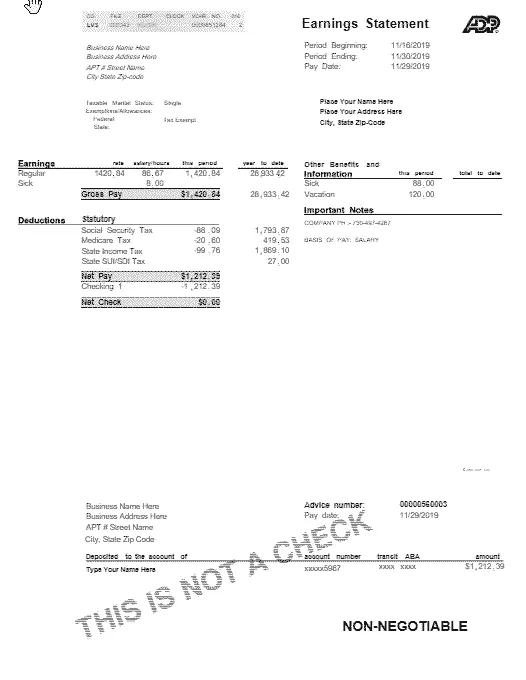

Hereu2019s How I Created 11 Income Streams and Bulletproofed My Financesreading_time11descriptionThis article was originally published in NextIdea our weekly newsletter. No other percentages can be used. The Medicare and Social Security tax are collectively known as FICA taxes Most employees do not qualify for these exemptions.

Get a travel insurance quote. Call travel insurance at 1-800-661-9060. Protecting your retirement income.

In the example of the company car employees would have to pay taxes on the amount it would cost to lease that same car. This tax rate applies only to bonuses or other supplemental income. Protecting your retirement income.

Fill in the employees details. Ways to Bank. Their name and the state where they live.

Paid time off PTO. If you dont have a source of income and cannot afford child support you will still be required to make a monthly child support payment. Need to start with an employees net after-tax pay and work your way back to gross pay.

This includes just two items. Also called Land Transfer tax property transfer tax land. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

For parents who have less than 25 percent placement. Please note I said all income again because you have to include your W-2 job income. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Invest in a better world. Get a travel insurance quote. If your employees dont qualify for tax exemptions on their regular.

Income Tax Calculator India 2018-2019. Tax calculators. If regular wages are also paid at the same time the flat rate of 22 only applies to the bonus.

Income Tax Calculator India 2019-2020. The employee may not have to pay for those benefits but they are responsible for paying the tax on the value of them. Some benefits employees receive are excluded and tax-exempt such as health insurance or meals.

It comes with just one competitive price40 plus 6 per employee per monththat includes all services. Income Tax Calculator India 2017-18. Youll also get check delivery access to reporting features integration options new-hire reporting tools yearly W-2 and 1099 delivery and account access for your employees to view their paychecks and update tax information.

This threshold is based on your filing status ie married single etc. Tax information Federal and state income taxes local taxes MedicareSocial Security taxes Wage garnishments. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

All tax tips and videos. Calculator to determine cost savings realized from a paycard. Youll check a box on the calculator if your employee is exempt from the federal income tax state income tax Medicare tax and Social Security tax.

Medicare can actually be thought of as 2 separate taxes. Municipal and provincial tax. Indicate the amount of the refund to deposit in this account.

Call travel insurance at 1-800-661-9060. Important Note on Calculator. It should not be relied upon to calculate exact taxes payroll or other financial data.

Check e-file status refund tracker. Invest in a better world. This plan comes with ADPs core payroll processing features including tax calculations withholdings and filings.

These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. YEAR 2022 2021 2020 Net Salary Per Select one. Pay stubs are critical for personal auditing and are helpful when completing year-end tax forms.

Pin On Debt Free In Sunny Ca Frugal Instagram Feed

Adp Vs Paychex Which Is Better For 2022

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Bank Statement Bank America Statement Template Bank Statement Bank Of America

Wisconsin Paycheck Calculator Adp

Pin On Places To Visit

Pin On Payroll Template

4 Steps That Helped Adp Shape The Future Of Workforce Analytics

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Adp Pay Stub Copy Generator Pdfsimpli

Pin On Payroll Checks

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Salary Paycheck

Adp Payroll Pricing And Fees 2022 Guide Forbes Advisor

Pin On Excel Templates

Adp Salaries Comparably

How To Calculate Taxable Wages A 2022 Guide